Article Guidance

Handling a mortgage broker could save you date, money and you will hassle whenever you are looking for a knowledgeable household loan buying or refinance a property. Discover how home loan brokers’ usage of those other loan providers can also be make it easier to go shopping for multiple price rates in one go, or find the right financial system having difficult borrowing from the bank or income records.

- What is a mortgage broker?

- What do mortgage brokers carry out?

- Benefits and drawbacks at work having a mortgage broker

- How can lenders get money?

- Large financial company vs. a lender: What is the variation?

- Large financial company compared to. a lender: What is the variation?

- How to decide on a large financial company

- Do i need to explore a mortgage broker?

What exactly is a mortgage broker?

A large financial company is actually a licensed monetary company exactly who works that have various loan providers- their job is to find the best interest rate and you will mortgage program to match a good borrower’s requires. Home loans you should never in fact lend money; they merely look for loan providers to suit your having.

Discover a home loan broker permit, a person has for taking federally mandated knowledge courses, experience a tight criminal and borrowing from the bank records look at and you can admission a great federal shot. Home loan brokers also have to meet up with the certification requirements from installment loans online in Utah each claim to do business into the, which could become bringing personal economic comments.

All of the brokers, and home loan originators (MLOs) who work in their eyes, should be authorized from the Nationwide Financial Certification Program Federal Registry (NMLS). It capture continuing education courses and really should renew its certificates a-year during the per county where they do business.

What exactly do lenders manage?

Mortgage brokers work on different financial institutions and lenders to include several lending options to their users. They have to be approved by the loan providers they are doing team with, and you will conform to the federal and state financing guidance to own home loan lending.

An MLO doing work for a different large financial company is even familiar with lots of other lenders’ products and interest rates, giving people a great deal more selection than simply that they had make do looking an individual home loan bank. MLOs constantly display screen the eye costs and software from several loan providers, saving you time and money you would’ve spent shopping around your self.

Just how can home loans receives a commission?

Home loans found a fee for its services, usually based on a fixed portion of the loan number. Brokers are paid off truly because of the buyers otherwise by the bank – but do not from the each other.

Broker payment need to be revealed into the loan estimate and you can closing revelation models obtain in home loan processes. Federal law is actually crystal-clear how a loan creator can also be be paid, and you can brokers have to go after stringent settlement recommendations, including:

- The fresh new commission payment cannot be hiked in line with the terms of the borrowed funds otherwise financing sort of.

Large financial company compared to. a lender: What’s the change?

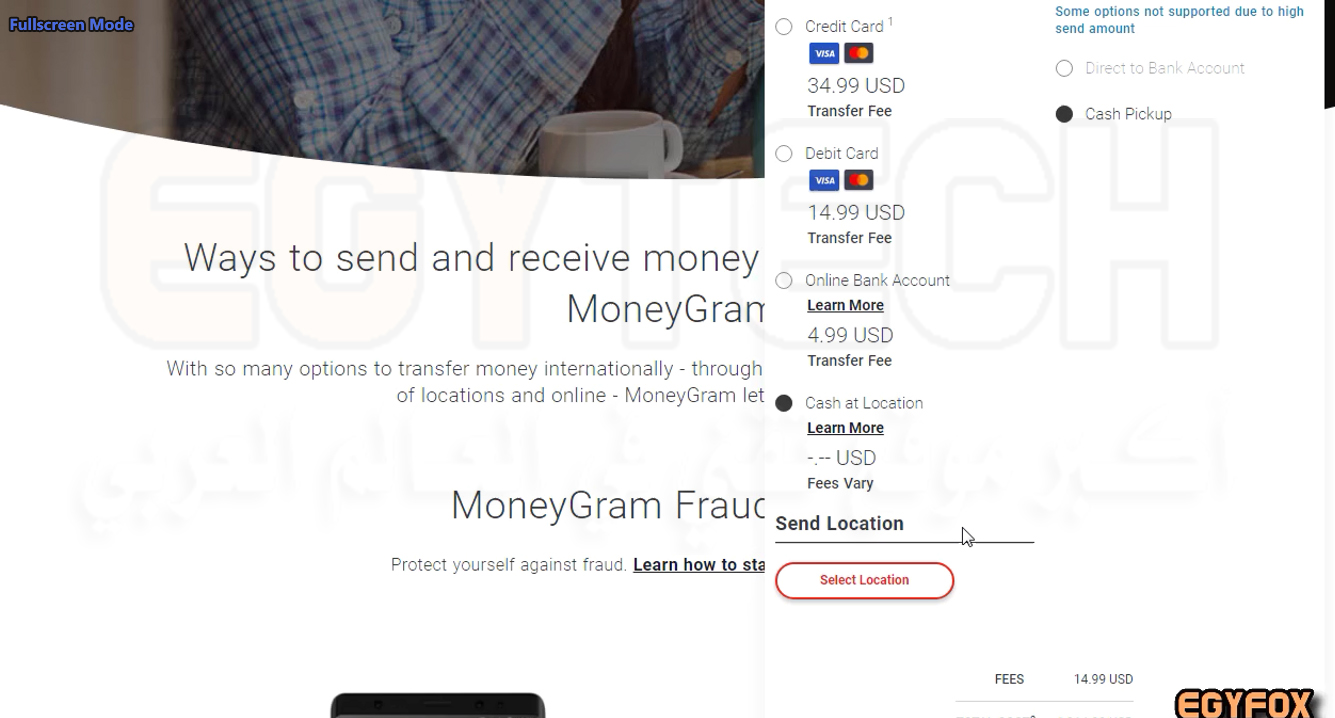

Because you go shopping for lenders, you might score has the benefit of away from both home loans and you may mortgage financial institutions. Often referred to as a beneficial lender getting short, a mortgage bank try a financial institution one gives your currency physically for your house mortgage requires. The fresh desk less than reflects just how a mortgage broker is different from an excellent lender:

Large financial company compared to. a lender: What’s the difference?

Of numerous homebuyers and you can home owners choose a nationwide otherwise local merchandising financial or borrowing from the bank partnership for their home loan need, because of the capability of using and you will to make monthly obligations where they do a majority of their normal financial. Below try an area-by-top investigations of some items worth considering if you find yourself choosing anywhere between a mortgage broker and a financial:

How to choose a mortgage broker

You need to contact three to five more lenders in order to rating an idea of whatever they could offer. If you do not possess certain borrowing from the bank or income demands, examine pricing away from financial finance companies and you may retail loan providers making sure you’re going to get an informed deal. Try a compare rate tool if you value a loan provider to help you send you competing also offers based on your financial character.