Its generally hard for Deferred Action for Young people Arrivals (DACA) users to acquire loans from banks – but it’s however you are able to. Of a lot banking companies and you can lenders have a tendency to imagine you a top-risk private due to your position. Of a lot banks think DACA to get temporary and never protected due to the fact DACA is readily affected by You.S. immigration rules. Yet not, DACA readers is also acquire from other lenders. You can aquire signature loans, student education loans, and you can lenders out of financial institutions and other loan providers. This informative article shows you ways to get unsecured loans, figuratively speaking, and you will mortgage brokers as the a great DACA individual.

What kind of Financing Is DACA Users Get?

You start with new National government, Deferred Step getting Teens Arrivals ( DACA) receiver you will definitely stay-in the united states and availableness a-work enable, license, and you can Social Safety matter. Regardless of this, acquiring bank loans stays very hard for Dreamers, who’re believed highest-risk borrowers.

not, Dreamers have certain mortgage choices. People with DACA position are eligible private loans, student loans, and you can lenders. Your odds of efficiently taking a loan confidence the chance updates otherwise exactly how high-risk away from a debtor youre.

Can also be DACA Recipients Rating Unsecured loans?

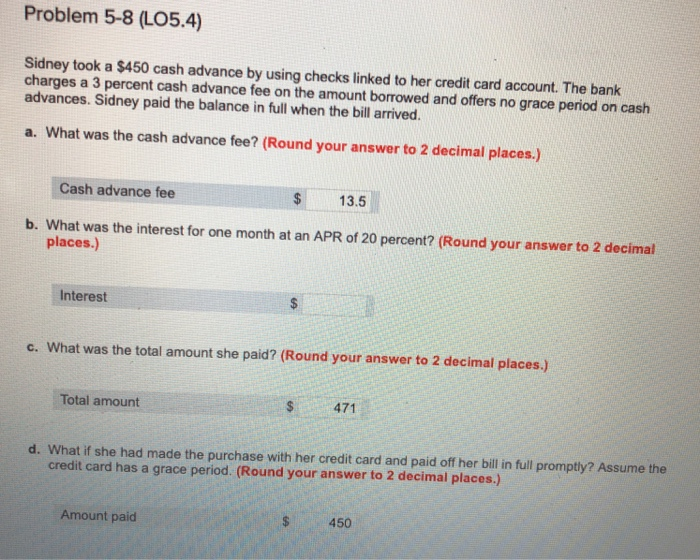

Usually, DACA users meet the requirements private financing. Unsecured loans is actually financing considering when it comes to private need. Instance, you could fund the educational costs will set you back otherwise family fixes. Although not, of a lot lenders think DACA loans a massive risk. Since legislation and status of DACA you can expect to transform at any time, there is certainly a risk you to You.S. Citizenship and Immigration Attributes (USCIS) you can expect to deport your subsequently. The financial institution do not be able to get well the money if it happened.

At the same time, of many Dreamers don’t have the necessary data files or substantial credit history. Many plus lack a beneficial co-signer or someone prepared to verify repayment when they dont pay their financing. Financial institutions are reluctant to financing so you’re able to DACA readers. However, alternative individual lenders is generally more likely to agree the loan request.

Is also DACA Readers Get Loans from banks having University?

DACA system beneficiaries dont qualify for federal financial aid otherwise federal student education loans. You could talk about alternative educational funding solutions. Undocumented pupils be eligible for inside-county tuition prices in a number of states, such Nyc, Florida, and you may Illinois. Your own university get request you to complete this new 100 % free Software to possess Government Scholar https://paydayloanalabama.com/broomtown/ Aid (FAFSA) to find out if their country’s Company out of Knowledge or the college in itself gives you educational funding.

Depending on a state property condition, specific claims like Ca, Connecticut, and Minnesota possess financial aid programs particularly for Dreamers. You need to speak to your school’s educational funding office to ask your own eligibility. You can also start looking for scholarships and grants to possess undocumented immigrants in the highschool.

While doing so, specific schools and you can loan providers consider DACA people is global children. If this is the scenario, you may be able to get financial help having all over the world pupils, including individual scholarships and grants otherwise personal figuratively speaking. not, financial institutions may consider DACA college loans due to the fact alternative funds, that’ll lead to higher rates. Very carefully think about the installment regards to one loan you’re taking out, including the loan amount, rates of interest, and you will whether or not discover fixed cost, payment per month will cost you, origination charges, and you may autopay choice.

Can also be DACA Users Get home Finance?

DACA readers meet the requirements getting lenders. Will, antique financial institutions will not approve the application, however, there are choice possibilities. You to definitely option is a loan regarding Government Homes Administration (FHA) customized clearly to have Dreamers. There are five conditions to help you be considered because the a low-permanent citizen:

You desire an employment Authorization Document (EAD) regarding USCIS to show you really have permission be effective about United states.

You might strive for that loan regarding a private bank. These types of loans tend to have a lot fewer documentation conditions. But not, they will certainly probably assume the absolute minimum credit history regarding 650.

What exactly do You really need to Yield to Get a mortgage as the a good DACA Individual?

There are also to show you may have a reliable income and show a merchant account balance to show you can afford so you can purchase a property.