Many reasons exist as to why some body enjoy the element to help you refinance their home. Once you re-finance, you are generally repaying your current mortgage and you can substitution it with a brand new loan. According to of numerous affairs particularly exactly how much you https://paydayloancolorado.net/san-luis/ still owe into the home and you may precisely what the market has been doing, refinancing should be an incredible benefit to you while the a citizen. As an armed forces user or veteran, there is the directly to benefit from the unparalleled Va Home loan. That it gets to refinancing and certainly will become a powerful equipment actually when you own your house.

Score a diminished Interest to the Va IRRRL

The fresh new Virtual assistant Interest Protection Refinance mortgage (Va IRRRL), possibly named the brand new Va improve home mortgage refinance loan, are a powerful product that will help you score less interest. When you have a preexisting Va Financing therefore notice that rates of interest was straight down now than simply these people were when you first purchased your home, this might be an enjoyable experience to take advantage of brand new IRRRL. With an effective Virtual assistant Mortgage, this new IRRRL enables you to quickly re-finance your loan and have now an interest rate that’s using your initially you to definitely, giving you tall offers over the years.

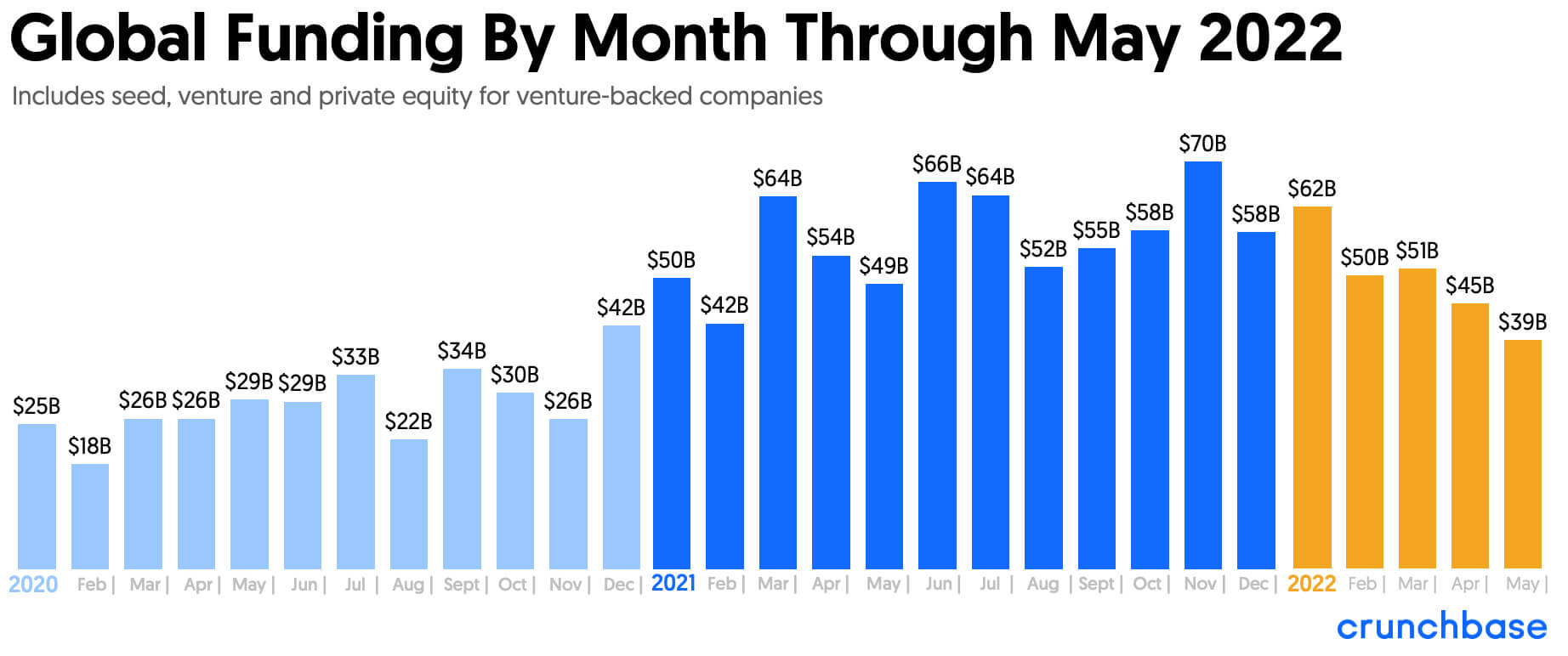

Centered on Forbes, in the event the pricing in 2020 dipped off 3.5% to three.13%, refinancing financing sprang more than 60% in just a few days. Towards the Virtual assistant IRRRL you could gain benefit from the strong finance supplied by the brand new Department away from Pros Affairs and take advantage of rates of interest on the market today that can n’t have already been available at enough time of purchasing your property. Whenever interest rates drop, this provides a chance for you to cut large along the lifetime of your loan.

The new Virtual assistant IRRRL even offers a smooth procedure with shorter documentation than just typical refinancing choices. Oftentimes, your current payment is certainly going off and this mortgage keeps a reduced capital fee than simply traditional Va Home loans. Instead of the high quality commission, the funding percentage to possess a Virtual assistant IRRRL is just 0.5% which might be included in the complete amount borrowed. It mortgage is just offered if the latest mortgage are an effective Virtual assistant Financing and helps you facilitate the procedure and then have a good straight down price brief.

Score Money back which have an effective Va Dollars-Away Loan

Sometimes in daily life whenever with some extra dollars was a huge benefit. Out of repaying loans and updating or renovating your home to needing cash having emergencies, existence happens being in a position to take-out dollars on the equity in your home can be a robust tool. Whenever you are having to tap into the newest collateral off your house, the latest Va Bucks-Aside financing is a beneficial choice.

Which financing helps you score bucks from the guarantee in your household if you find yourself nonetheless taking advantage of a similar high Virtual assistant Loan pros. Having an excellent Virtual assistant Bucks-Out re-finance there is no private home loan insurance (PMI). As you must be eligible to found a certification out-of Qualifications, it’s not necessary to get in a current Virtual assistant Financing to make use of this re-finance alternative.

To help you meet the requirements for taking advantage of a profit-aside re-finance, the collateral of your home must be equal-to otherwise greater-compared to amount of money you want to take out otherwise use, plus people settlement costs. The brand new mortgage, for instance the Va IRRRL, will change your existing mortgage and can portray around 100% of your own property’s well worth. Like almost every other Va Money, that it refinance was susceptible to a funding fee. These costs are the same as the those you would see in antique Va Lenders from the dos.3% getting first-time profiles and you will 3.6% each subsequent fool around with.

Shorten the life span of one’s Va Mortgage

Another reason particular home owners propose to re-finance is really so they could reduce the newest lifetime of its mortgage and you can shell out their home out-of less. When you find yourself within the a financial lay in which this might be possible, this will be a good benefit. By turning your existing loan on a shorter label, your generally speaking predict a higher payment. This approach can help you save certain tall money that you will have paid-in notice over the years which help your wind up expenses your loan smaller. If this is your ultimate goal with refinancing, i encourage performing directly that have that loan manager who will let you dictate the eligibility and you may solutions.