The brand new residence’s really worth will regulate how far you borrowed from inside the fees. Genetics income tax legislation are different about U.S., you would-be susceptible to home, funding gains, assets or any other taxes.

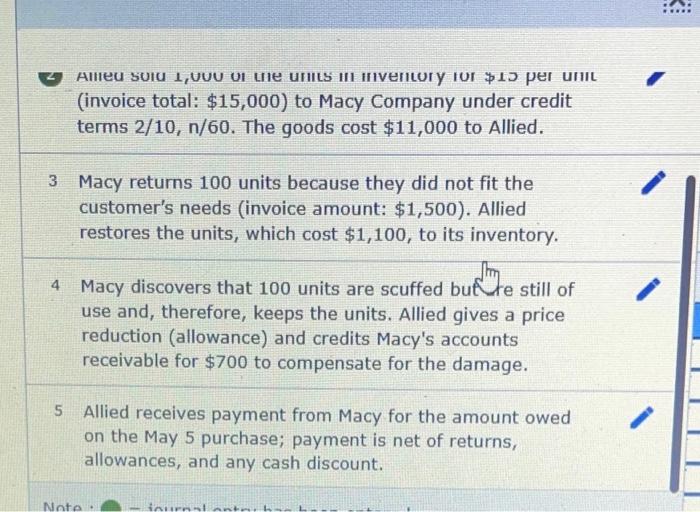

4. Look at one expense owed

Should your house continues to have expense facing they otherwise an income tax lien, observe how far try owed and you will just what payments is.

5. Thought taking qualified advice

Gurus might help obvious problem and you can show people debt of this our home, new fees you are able to owe because heir, and just how selling the house usually effect your money. You can look at lawyers (if at all possible that have property think and you will a house systems), home coordinators, accountants, economic advisers, believe officials and you may/otherwise philanthropic experts.

You might have to depend way more heavily with the an accountant to assess the income tax state; legal counsel to spell it out the courtroom possibilities for possession and buying away almost every other heirs; otherwise a financial mentor to talk about the best way to Cokedale loans maximize your own this new asset.

For many who elect to hire multiple elite, cause them to in contact with both. This can make your lifetime easier.

Relocate

The passed down domestic would-be a great no. 1 home otherwise vacation home. The fresh new caveat: This is exactly often the priciest solution. Prospective costs range from the home loan, taxation, repair, repairs and you may insurance coverage, in addition to to find out any co-inheritors, in the event the relevant.

Renting from the inherited assets you certainly will offer some nice passive income, enables you to hold and you can grow a financial investment just like the house value values, and maintain our home regarding nearest and dearest. You can lease it to help you long-identity clients or even travelers a la Airbnb concept.

For those who have co-inheritors, you could potentially make them away and you may lease the house or property once the sole owner, or book it together with your co-owners, busting the expense and earnings. Either way, think to acquire property owner insurance coverage and you may employing a specialist landlord so you’re able to do the be right for you.

You could potentially offer your share in your house so you’re able to an excellent co-inheritor or you might promote the entire home. Attempting to sell this new passed down property could be the best way to break its value, find some dollars and you will/and take proper care of people remaining loans which was stored by brand new inactive person. Listed here are tips for selling your residence.

How exactly to money a genetic domestic

You will find several ways you could potentially funds a genetic family. Remember that simply how much your use might through the will cost you of buying out other heirs and paying off other the expenses.

Mortgage control

A home loan assumption happens when a person gets control a preexisting mortgage. The borrowed funds label, interest, monthly payment matter and you will all else concerning the mortgage wouldn’t transform. Really the only variation ‘s the person otherwise somebody financially responsible for the mortgage.

This 1 is the better in the event the most recent home loan possess greatest words than what you might make-do taking right out a separate financing. not all of the mortgage loans will be thought and you can, once they can be thought, the lender have to agree the individual or people delivering it over.

Buy or refinance loan

This type of choices makes it possible for one to put the mortgage on the title and, preferably, safe a very good interest rate. An effective refinance will be you can when your family features an opposite mortgage. Make sure to glance at latest financial pricing and store having several loan providers.

Cash-out refinance

A cash-away re-finance sets the loan on your own identity, could help locate a much better speed and you may lets you take advantage of the house’s collateral. It can provide cash so you’re able to target expenditures for example paying regarding co-inheritors or covering recovery or repair will set you back.