To buy a property try a massive performing regarding friends, it is going to be incredibly challenging when you’re just one mother or father. When you find yourself scared that there surely is no one otherwise so you’re able to bounce records off of, browse areas, or find out a resources, understand that there are numerous type some body and qualities out there so you’re able to browse the sense since a primary-big date homebuyer.

This short article go through the benefits and drawbacks of buying versus. leasing to help you dictate – given that just one mother or father – when the taking the plunge are a good idea available at this point. But very first, let us touch on funds.

Wearing down the funds

If you are potential homebuyers worry about a slight rise in financial pricing, its smart to consider you to fifteen% rates have been basic back into the first eighties. Prices haven’t been a lot more than 5% since 2010, and you can, just last year, the average interest was just dos.79%. Therefore even in the event cost rise, they aren’t predicted commit a lot more than cuatro% into the 2022. It means homeowners and you will people remain in search of pricing which make also the current high home prices affordable.

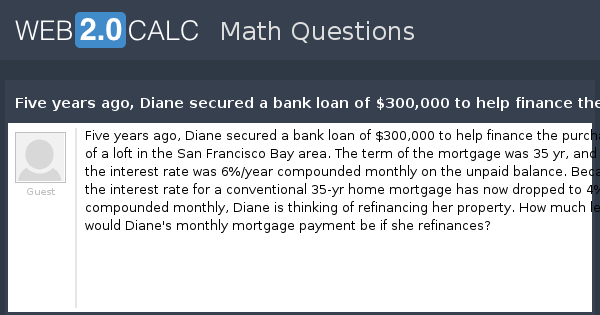

Don’t forget that exactly as home prices has increased just like the pandemic been, rents has risen, also. Listed below are some all of our mortgage calculator so you can estimate their monthly payments to own an evaluation. Upcoming consult financing manager who’ll enjoy into your finances to help develop a personalized homebuying finances to utilize as the techniques.

Benefits of becoming a homeowner

Remain renting and you’re subject to a property manager which you’ll increase your rent, evict you or promote this building downright. But if you get a property having a fixed-price financial, your monthly premiums stand a similar month immediately following few days, time after time. One to consistency makes it possible to package and you can rescue with other costs in the future. Yes, you will be taking on even more casing costs, like taxation and insurance coverage, however, those ought not to changes you to definitely considerably throughout the years.

Considering a current Government Set aside research, in 2019, You.S. property owners got a median web value of $255,000, while tenants have been at only $6,300. That’s a good 40X change! It is obvious one homeownership is among the how can i make wide range. Since your household values and you also reduce the borrowed funds, your generate security from the assets, something gurus telephone call pushed offers.

A different benefit of homeownership originates from taxes. For folks who itemize the annual write-offs, you’re capable together with lower your nonexempt money of the any type of you are paying for assets fees, financial attract and – either – home loan insurance policies. Keep in mind to dicuss so you can an income tax professional before applying for a mortgage only on possible tax loans – they truly are various other in just about any state.

Renters constantly aren’t permitted to make any alter to their rentals. Some aren’t also permitted to paint. By using it through to yourself to wade Doing it yourself, it’ll probably emerge from your pocket, perhaps not the fresh new landlords. But as the a homeowner, you are able to personalize your room at all your sweat equity otherwise finances allows. Along with, whenever you are a pet holder, there is the liberty so that your hairy companion accept your without requesting permission!

The feel-an effective advantages of delivering associated with your neighborhood society is something that home owners and you may renters usually takes part when you look at the just as. Yet not, it is a fact one to clients – especially younger renters – will flow a few times more 10 or 15 years than simply home owners commonly. For this reason it name to find a house putting down root.

When you find yourself raising a household given that just one mother, school area top quality is a big part of the where is always to i real time decision. It is good to own kids having a steady society with university chums that they’ll become adults having – they’ve been placing off roots, also! Very, it is essential to be mindful of the school district you’ll real time inside. Discover those that are very well financed, safe and has a lot of even more-curricular factors for taking the pressure regarding you because the a just way to obtain supervision. Together with, you earn the opportunity to build much time-long-lasting relationships to the moms and dads of the kid’s classmates.

Advantages of being a renter

When you find yourself to get a house is known as a no-brainer, there isn’t any be certain that you will notice income later on. Sure, paying off the loan and you will keeping up with house repair produces home guarantee, however, there is a large number of factors that will be off their manage. What’ll this new cost savings end up like once you wear it the new markets? Tend to your own getting among homes for sale at that time? Performed a park otherwise a parking lot get depending near the domestic? All of these make a difference to your selling rate, creating your the home of shed into the well worth when it is time to offer. Renters do not have that it over its minds.

If you’re a resident, you need to save and you can cover family repairs which can be bound to https://speedycashloan.net/loans/bad-credit-line-of-credit/ takes place sooner or later. To own tenants, it is another person’s disease. Regarding the expense together with problems out of hiring someone to manage fixes on your own flat, that is the landlord’s headache.

Home ownership ought not to prevent you from switching efforts otherwise transferring to some other city, however it is not as simple as merely breaking the rent and you may speaing frankly about the fresh drop out. Possibly you happen to be an occupant who wants a choice of having the ability to alter things up in the event the locals score also noisy or the travel becomes as well longpared so you’re able to people, clients can usually act much faster when designing a shift.

Tenants, by meaning, spend monthly lease. And some ones need to cough upwards having cable, tools and you may – when they smart – renters insurance. Additionally, home owners shell out home loan dominating and you can focus, property fees, homeowner’s insurance policies, both home loan insurance rates, regular restoration, safeguards functions as well as new utilities in the above list after which specific. There are even homeowner’s association (HOA) charge having condos or gated communities. Thus if you’re there are many advantages to to order a home, home owners usually write far more monitors than renters do.

Happy to progress?

As one mother, you ily’s sole breadwinner, however, determining whether to get or lease is not a strictly economic decision. There are psychological facts which go in it as well. If you’d like assist weighing the huge benefits and cons, do not hesitate to extend.

Movement Financial can be obtained to love and cost people, and we had choose to help you know if to shop for is the right move to you personally and you can, if so, what you could manage. To get going, select a loan administrator in your neighborhood your family need to telephone call house!

Mitch Mitchell are a self-employed factor to Movement’s profit department. The guy in addition to produces from the tech, on the web security, the brand new digital training area, take a trip, and you will living with pet. However need real time somewhere loving.