The eye costs getting a mortgage once case of bankruptcy differ, depending on the mortgage in addition to borrower’s credit rating.

Interest rates go up and down, based financial factors. As an example, from inside the 2020 and you can 2021, this new U.S. Federal Set-aside left rates of interest over the years reasonable. While you are rates fluctuate, brand new gap between your rate to own a debtor with a high credit rating and one which have a decreased credit score remains on a comparable.

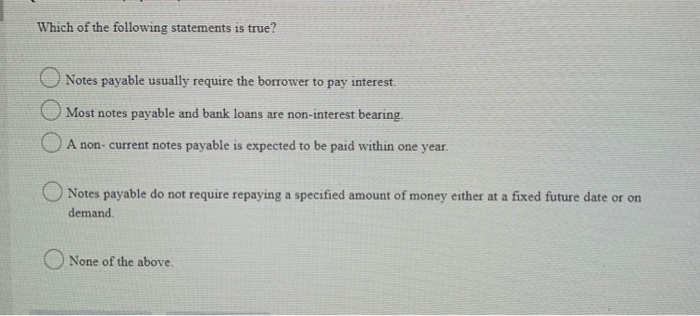

It graph, exhibiting cost regarding 2021, compares rates for several style of money as well as how it vary which have credit scores:

Just what are FHA Financing?

FHA financing try mortgage loans supported by new Federal Homes Expert, readily available for people who have troubles bringing a traditional loan on account of a poor credit history or money. FHA loans keeps convenient borrowing requirements minimizing off costs.

Since U.S. authorities backs brand new funds, lending establishments are more prepared to give them to individuals with bad credit scores, as the lower your credit score, the fresh new more challenging it can be to track down a lender.

A borrower having an effective FICO rating of 580 can be be eligible for a keen FHA financial having a deposit out of step three.5% and some one having a beneficial 10% down-payment can be meet the requirements with a 400 rating. The reduced new rating, the higher the speed and harder it may be discover a lender. When you are implementing having a credit rating below 600 is achievable, below 2% off FHA financial borrowers got a credit rating you to definitely lower early for the 2021.

Section 13 – A couple of years when the bundle money have been made timely and brand new trustee of your bankruptcy proceeding provides a fine.

Just what are Traditional Money?

They are certainly not protected of the government, but they typically have a knowledgeable interest levels and you can terminology, which means that all the way down monthly payments. The most used style of old-fashioned financial are 30-year fixed-price, and this taken into account 79% regarding mortgages ranging from 2019 and you may 2021, predicated on Frost Mortgage Technical https://paydayloanflorida.net/mcintosh/.

Antique finance want a credit rating from 620 or more. The greater the fresh rating, the higher the fresh terms and conditions. One of the biggest masters is that an advance payment of 20% form it’s not necessary to shell out individual home loan insurance, that can create many to help you home financing.

Even if you do not set-out 20% within closure, just like the security in the house is located at 20%, the new PMI is dropped. Which have an FHA mortgage, they never falls, and you’ve got to blow a single-day up-front advanced of 1.75% of legs amount of the loan.

- A bankruptcy proceeding Four years once discharge date

- Section thirteen Couple of years. When your case try disregarded, and therefore happens when anyone declaring personal bankruptcy will not proceed with the package, it’s number of years.

Preciselywhat are Va Financing?

Brand new Va mortgage program, administered by the You.S. Agency off Pros Items, also offers reasonable-rates finance in order to pros and you will energetic armed forces employees. Licensed individuals aren’t required to build off costs, a number of the closing costs try forgiven and individuals don’t have to invest home loan insurance coverage.

You will find several requirements if you have undergone a bankruptcy if they need to get good Va financing.

Chapter 7

- Zero later costs because case of bankruptcy submitting;

- Zero derogatory borrowing (collections) while the bankruptcy;

- The very least median credit score off 530-640 (according to where the borrower lifetime);

- Two year prepared several months once discharge.

Chapter thirteen

- A minimum 12 months waiting of bankruptcy initiation big date;

- A suitable overall performance of your bankruptcy payment bundle;

- No late money following big date of one’s 341 (meeting out-of loan providers and you will bankruptcy trustee);